Exercise

Set 15

THE COMPLETE MODEL

I. Objectives

- To show the linkages between

the goods market and the money market

- To explain changes in

GDP, inflation and interest rates simultaneously

- To show how fiscal and

monetary policies affect the economy

II. Model

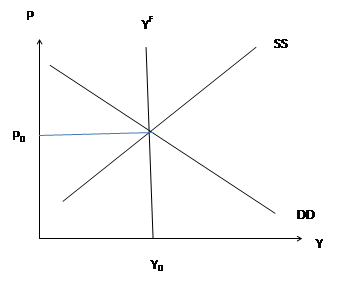

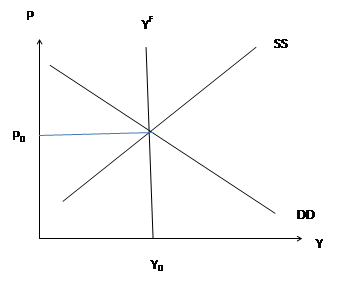

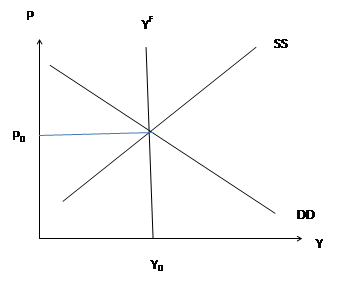

- Equilibrium in the goods

market is depicted

in the DD/SS framework (aka

the AD-AS model). The intersection of DD and SS curves (equivalently,

AD and SRAS curves) yields equilibrium GDP and price level in the short

run. The

long-run aggregate supply curve is denoted by Yf,

also known as potential GDP. See Fig. 1.

Note: The DD curve will shift right if there is an increase in

aggregate demand (or aggregate expenditure AE). The SS curve will shift

right due to lower input prices and improvements in technology.

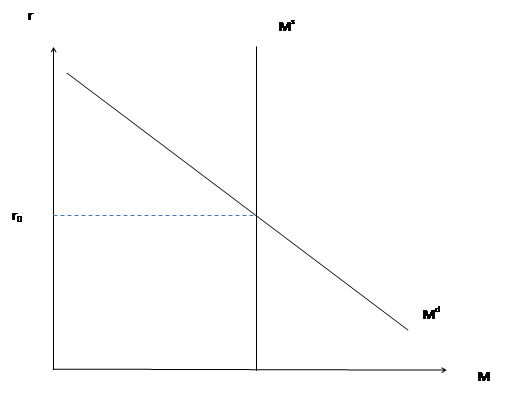

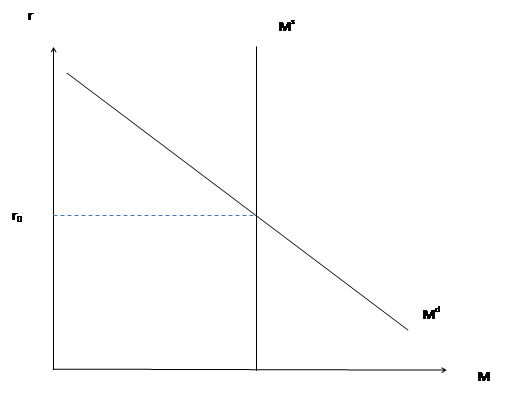

- Equilibrium in the money

market is depicted using

the Md/Ms framework.

The intersection of the Md and

Ms curves

yields the equilibrium interest rate. See Fig. 2.

Note: Money demand will increase when GDP or the price level rises.

Money supply is controlled by the central bank.

Fig. 1. Equilibrium in the Goods

Market

Fig. 2. Equilibrium in the Money

Market

III. Questions

- Consider the goods market

equilibrium in Fig. 1.

- Can

we conclude that the economy

is at full

employment?

- Can we

say that the current unemployment rate is greater

than the natural rate

of unemployment?

- Suppose there is a decline

in GDP in one of our major trading partners, say Canada.

- How will the fall in

Canadian GDP affect the U.S. goods market--in particular, what will

happen to U.S. GDP and the price level?

- As a result of the changes

in U.S. GDP and price level, what will happen in the U.S. money market?

Explain the effect on U.S. interest rates.

- Based on the foregoing, we

conclude that a recession in a trading partner will lead to [ lower |

higher ] incomes in the U.S.

- Suppose labor productivity

rises.

- Use Fig. 1 to explain the

effects on GDP and the price level in the short run.

- Use Fig. 2 to establish

the changes in the money market. What can we say about the net effect

on interest rates?

- What is the likely effect

on the government's budget balance?

- Suppose the government cuts

spending on the military and infrastructure.

- Use Fig. 1 to explain the

effects on GDP and the price level in the short run.

- Use Fig. 2 to establish

the changes in the money market. What can we say about the net effect

on interest rates?

- What is the likely effect

on the government's budget balance?

- What is the effect of the

fiscal policy on unemployment?

- Which other fiscal policy

is likely to have similar effects as the decrease in G?

- Suppose the Federal Reserve

buys government securities in an open-market operation.

- Use Fig. 2 to establish

the changes in the money market. What is the net change

in interest rates?

- Use Fig. 1 to explain

the effects on GDP and the price level in the short run. (Note:

Investment and consumption are affected by interest rates.)

- What is the effect of

the monetary policy on unemployment?

- Consider the

effect of the monetary policy on the budget balance: Will the

budget deficit increase or decrease?

- Consider the

likely effect of the Fed's action on the exchange rate: Will the value

of the dollar rise or fall?

Video: Solution to

Section III

Questions at

http://www.screencast.com/t/JFRPRuQDVOdL