Lecture 17

MONEY

1. Barter

- Exchange of goods

- Problems:

- Double coincidence of wants may not occur

- Arriving at the terms of exchange is problematic

2. Functions of money

- Medium of exchange:

Exchange goods for money

- Unit of account:

Standard unit for quoting prices

- Store of value:

Can be stored over time to be used later

3. Fiat money

- Decreed as money by the govt (issuer)

- No intrinsic value

- People use money to buy goods of intrinsic value

4. Liquidity

- Ease with which an asset can be converted into cash

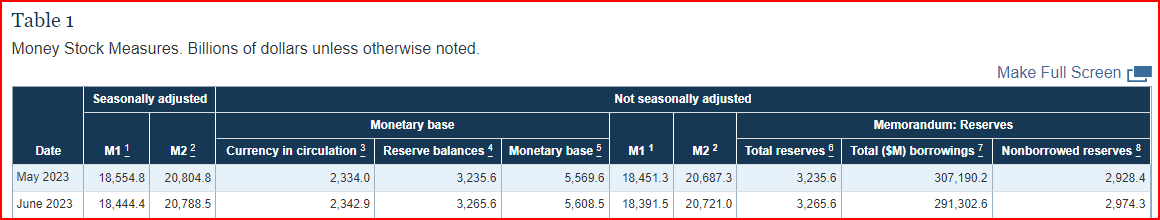

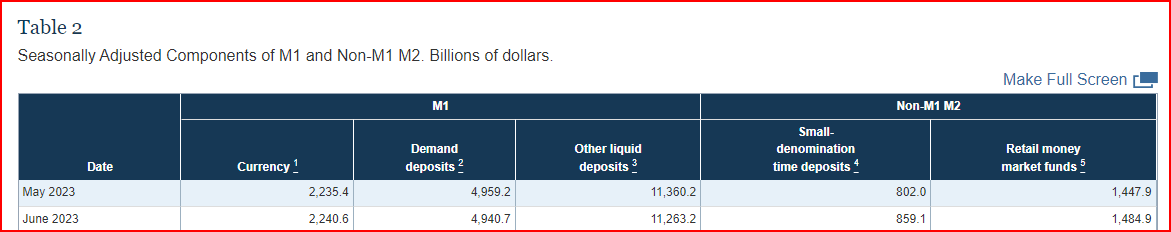

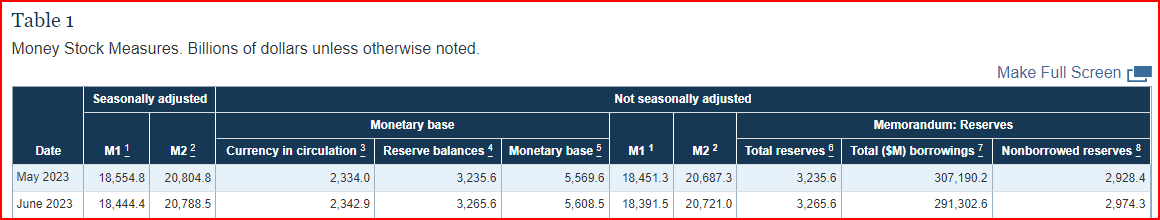

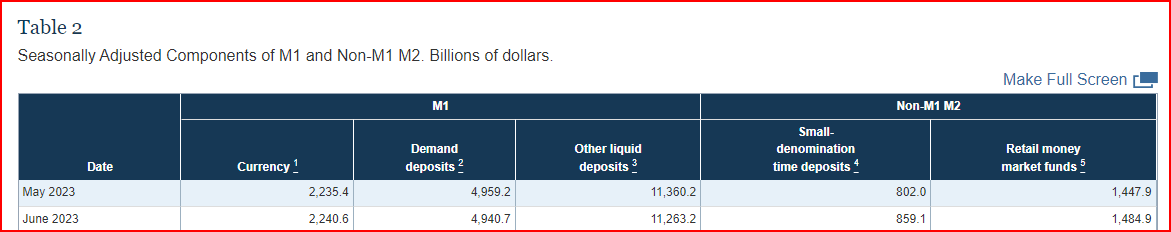

5. Measuring the stock of money

- M1 mainly consists of

- Currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions;

- Demand deposits at commercial banks; and

- Other liquid deposits, consisting of other checkable deposits (or OCDs, which inlcude share draft accounts at credit unions) and savings deposits (including money market deposit accounts).

- M2 mainly consists of M1 plus

- Small-denomination time deposits (time deposits in amounts of less than $100,000); and

- Balances in retail money market funds (MMFs).

For more recent data, go to Federal Reserve

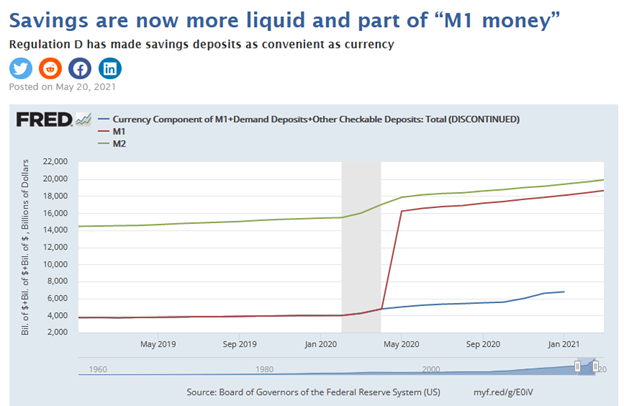

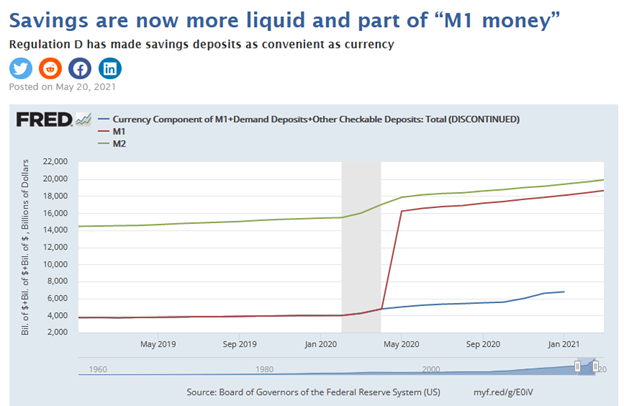

What changed on April 24, 202? The definition of M1 and M2

- Before April 24, 2020, savings accounts were not part of M1. M1 consisted of currency, demand deposits, and other highly liquid accounts called “other checkable deposits” (OCDs). An example of OCDs are the demand deposits at thrifts.

- But the limitation on the number of these transfers was lifted on April 24 as an amendment to Regulation D, which specifies how banks must classify deposit accounts. Savings deposits are now just as liquid and convenient as currency, demand deposits, and OCDs. To reflect this fact, savings deposits are now included in M1.

- The FRED graph above compares the new M1 with what would have been M1 under previous regulations, when it included only currency, demand deposits, and OCDs. From May 2020 on, M1 comprises currency, demand deposits, and a new item called “other liquid deposits.” These are the OCDs plus savings deposits. Previously, the OCDs consisted about 17% of M1. Now, the other liquid deposits consist about 70% of M1.

Source: https://fredblog.stlouisfed.org/2021/05/savings-are-now-more-liquid-and-part-of-m1-money/