Lecture 9

THE BALANCE OF PAYMENTS ACCOUNTS

1. The BoP Accounts

It is the statistical record of all economic transactions taking place between a country's residents and the rest of the world.

- Current account [trade in goods and services]

- Capital account [trade in assets by the private sector]

- Official reserves account [foreign-exchange transactions by central banks]

2. Accounting rules

a. Sign (+ or -) of entry

Credit (+): If transaction results in receipts from foreigners

Debit (-): If transaction results in payment to foreigners

b. Double-entry bookkeeping

Every international transaction enters the balance of payments accounts twice (a credit and a debit).

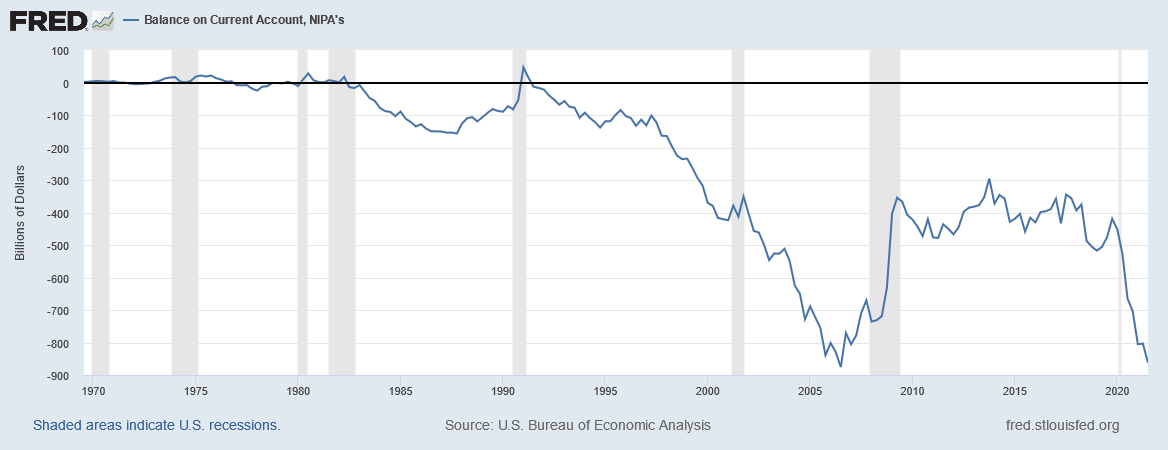

3. Current Account

(a) Merchandise trade:

- Exports and imports of goods

(b) Exports and imports of services:

- Tourism (expenditures by German tourists in Florida)

- Transportation (freight and insurance charges)

- Professional and other services (Management consulting fees, royalties, copyright fees)

(c) Investment income:

- Payments for the services of capital "working" abroad

- Interest payments and dividends

(d) Unilateral transfers:

- Government grants (foreign aid)

- Private remittances

- From emigrant workers to families

- Pensions to retired people living abroad

4. Capital Account

4. Capital Account

(a) Foreign direct investment (FDI)

- A country's residents acquire control over a foreign firm:

- Buy enough stock (10%)

- Take over the firm outright

- Build a new factory

(b) Portfolio investment

- Short-term

- Maturity of 1 year or less

- Checking accounts in foreign banks

- Certificates of deposit in foreign banks

- Long-term

- Maturity greater than 1 year

- Stocks and bonds of foreign corporations

Credits (capital inflows)

- Increase in foreign ownership of U.S. assets

- Decrease in U.S. ownership of foreign assets

5. Official Reserve Transactions

Central bank transactions in international reserve assets:

- Gold

- Foreign exchange reserves ($, €, ¥)

- SDR's [Asset created by the IMF; value based on $, €, ¥, £, RMB]

Credits

- Increase in foreign reserve assets held in the U.S.

- Decline in the Fed's foreign-exchange reserves

Example 1: If ORT = $60 bn for Bank of China, it means that the Chinese central bank is selling $60 bn worth forex reserves.

Example 2: If ORT = -$20 bn for the Reserve Bank of India, it means that the Indian central bank is buying $20 bn worth forex reserves.

6. Official settlements balance or Balance of payments

- The sum of the current account and the capital account

- If the balance of payments is positive, the central bank is gaining foreign-exchange reserves

7. Statistical Discrepancy (SD)

- Measurement errors in trade data

- Incorrect valuation of transactions

- Fraud: Some transactions may not be reported

8. Notation

CA = current a/c balance

KA = capital a/c balance

ORT = official reserve transactions

SD = statistical discrepancy

BP = balance of payments (Official settlements balance)

9. Accounting Relationships

(1) CA + KA + ORT + SD = 0

(2) BP = CA + KA + SD

(3) ORT = -BP

Questions

- If the balance of payments is positive (a surplus) in a year, has there been an increase, or a decrease in the stock of official reserve assets? [Hint: Use eq (3).]

- Assume that the statistical discrepancy is zero. If a country's current account is in deficit, and private foreign investors do not buy any of the country's assets, is the central bank selling, or buying, foreign-exchange reserves?

Home

4. Capital Account

4. Capital Account